TurboTax Self-Employed Online Tax Preparation: A Guide for Child Care Businesses

2024 Tax Year Edition

About Playground

Playground is child care management software that helps providers lower costs, eliminate busywork, and make families happier. We believe that providers should focus on providing incredible child care — the kind of work that only people can do — and that software should manage the rest. We’re building the child care management platform that eliminates the administrative work of running a center. Our top-rated software includes essential features like billing, family engagement, digital paperwork, attendance, payroll, food program management, automatic marketing, and more. Enjoy live human support with response times below 60 seconds. Schedule a free demo today to see why 300,000+ satisfied child care providers, teachers, and families use Playground.

Why Tax Prep Software is a Good Idea for Child Care Business Owners

Many child care business owners can prepare their own taxes. Using tax software is a great way to save yourself time and money. It also can give you peace of mind since many calculations are performed for you and there are automated cross-checks to ensure you are properly accounting for your revenue and expenses. According to the IRS, filing electronically helps you avoid common and costly errors. Best of all, it puts you in the driver’s seat of this essential business responsibility - filing your annual tax return.

How to Use This Guide

You may feel a bit intimidated by the idea of doing your own taxes for your child care business, but using this guide, and other tools built just for you, will prepare you to have a hassle-free experience that can save you money, ward off the risk of audit, and help you set goals to improve your business practices and tax preparation for many years to come. You’ll come out of tax season confident about your filing and your understanding of it.

This guide is best for self-employed child care business owners. These may include home-based family child care programs or child care centers that are owned by a sole proprietor.

It’s best to use this guide as a reference while you’re preparing for and completing your tax filing for your child care business. The goal of this guide is to allow you to accurately claim your child care business revenue and expenses with a focus on data entry that will form your Schedule C. Though this guide will not review the tax preparation associated with your personal (non-business) taxes, using tax software for your business filing will allow you to ensure you’re accurately claiming your personal credits and other items as well!

Introduction to TurboTax and Your Tax Filing

TurboTax* offers various versions of its tax products. First, you will need to decide if you want to prepare your taxes using the online version or a software download. For this guide, we used the online Self-Employed version of the software. In this version, you have access to essential forms such as the Schedule C, and the ability to search for business deductions that you can benefit from. Those features are not available through the basic package. You will also have the option to accept the MAX Defend & Restore protection service for an additional charge. We would recommend that providers who are completing their own taxes purchase the MAX Defend & Restore because it will give you the added protection of full audit representation, identity theft restoration features, and priority, individual support from a specialist to answer questions as you prepare your filing.

Understanding the Goal

As you navigate through the system, understand that the goal is to ensure you have a fair and accurate return so that you are protected in the event of an audit. The best way to avoid questions by the IRS is to avoid any issues that increase your chances of an audit, usually referred to as “red flags.” The most common red flags for child care businesses are:

Not including all your income on your taxes – such as leaving out a 1099 you received from grant funding.

Claiming irrelevant expenses or ones that are unusually high — like a provider who claimed $40,000 in cell phone expenses for herself each year.

Taking a very large loss on your business — businesses will take a loss from time to time, but you want to avoid having losses that are far more than what you earned. If you have not turned a profit in three of five consecutive years, you could be at risk of being determined to be a “hobby” and not a business by the IRS (which will greatly change your ability to deduct expenses).

Claiming 100% use of your vehicle — this is especially true for home-based family child care providers. Some of you may have a van or car you use for transportation — that’s alright; however, reporting that the vehicle is only used for work (and never for personal reasons) can draw attention since it is less common.

To help prepare your taxes with ease, you want to be sure that you have your revenue and expense records up-to-date and handy. Perhaps you have an accounting system where this data can be pulled from, or you have a record keeping system with this information. You will generally need:

1099 forms

Bank and credit card records

Canceled checks

Year-end or weekly receipts that show what parents paid for childcare

Paid receipts or invoices for goods or services that you purchased

Payroll records, if applicable

Mileage records documenting the business use of your vehicle

Time-Space percentage calculation for family child care providers

The documentation of your annual business use of home expenses, such as utilities or property tax

First Things First

You will need to enter basic demographic information about yourself (and your spouse and dependents, if you have any):

Name

Social Security Number (SSN)

Date of birth

Marital status

Dependents

Address

Other information to help determine your personal tax credits, including if you are a U.S. citizen; were a student last year; can be claimed as a dependent on another person’s taxes, or have any dependents to claim on your taxes.

And other information to help determine your personal tax credits and liabilities.

Next, you will also be asked to list your occupation, and you can choose Childcare Provider from the dropdown list.

Entering Business Income and Expenses

TurboTax will personalize questions and suggested deductions based on your industry. You can enter the type of work you do as “daycare services” to get personalized features for your industry. This is also necessary for the business code 624410 to be automatically applied to your business type. You’ll then enter basic information about your business (i.e. – name and address). You’ll also enter your Employer Identification Number, EIN, (if you have one), and the number of W-2 employees if you have them. If you don’t have an EIN, consider getting one for privacy reasons. But you can only use an EIN if it was created within the tax year. So, if you created an EIN on January 15, 2025, you could not use it for your 2024 tax return.

Method of accounting – This is a required entry on tax filings, businesses must state if they use the Cash or Accrual accounting method. TurboTax will automatically assign the Cash Method, which is the most common accounting method for small businesses, including child care businesses. This means that your transactions are accounted for at the time you receive a payment or when you pay an expense. You can edit to change to the accrual or another method if it applies but it is uncommon for child care providers.

Income

Entering your income is pretty straightforward.

The system asks, “What type of income did you receive for this work?”.

Your revenue should include all the money you took in for your child care business from all sources, even if you are not issued a 1099. This should include cash and money from cash apps for your business.

The most common response for child care businesses will be:

Other Self Employment Income. This includes cash, checks, and 1099-K forms for payments through apps received from families.

Form 1099-NEC. Here you will enter details from the 1099-NECs that you receive. That stands for non-employee compensation. Likely you will receive a 1099-NEC for other business-related payments received. For instance, if you receive a subsidy or any other contract payments, and you were issued a 1099- NEC, you will include those here. This will also include grants and awards, or other taxable income that came to your program through state funding, like any food program (CACFP) payments received.

The system also lists Uncommon Income as an option. This usually will not be applicable as it refers to prizes or awards. Be sure to list any grants that you received as Form 1099- NEC income. Doing that will be sure that it is taxed correctly as your self-employed income.

The system will ask if you received payments through Square. If so, there will be an option for you to import those payments directly into TurboTax.

Note – You may have received a Form 1099-K from app-based payment processors like Square, Venmo, and Cash App. This form covers any self-employed income you received through this payment processor for the tax year. If you automatically import your Square info into TurboTax, don't include the income from your Square 1099-K when you enter your income, as it'll result in this income being reported twice. This is optional and is meant to make reporting Square income for you, but you do not have to import. You can enter your information manually if that’s easier for you.

Here are some helpful worksheets that you can use to organize your income so that you can enter it into the tax system. They can also keep your taxes organized so that you remember what your Schedule C consists of once it’s generated:

1099 Income

Expenses

You want to make sure you have records of your costs, ideally, receipts showing payment for expenses, but you can also, in most cases, use canceled checks, invoices, or credit card and bank records. It is critical that any proof of an expense show:

• That you paid the expense.

• The amount you paid.

• The date you paid for it.

• A description of the item purchased, or service received.

o The system will first show you suggested expenses based on your industry, Daycare Services. TurboTax also provides a downloadable checklist of recommended and less common deductions for child care businesses. We do not recommend that you use this checklist because it does not provide guidance on the proper calculation of business expenses, which could lead to inaccurate entries. Instead, utilize the charts that you find within this guide which were developed using the Confidence in Quality Tax Prep Rubric©. We recommend you have this guide handy to cross-reference with the TurboTax categories as you enter your data.

You will first be able to check off your expenses in the Recommended section, which will be common expenses like Supplies, Home Office (this is the business use of a home for family child care businesses), and other expenses. You will then have the opportunity to check off all other expenses that you have in less common categories. Here, we will review some of the key deductions that you should be aware of with a worksheet that you can enter your expenses into before entering into TurboTax.

Common Expenses

| Category | Description | Total Expenses ($) |

|---|---|---|

| Advertising | Here you’ll enter costs to promote your business including online and print ad costs, brochures, mailers, flyers, business cards, and website costs. | |

| Vehicle | You will note if the vehicle is owned or leased by you and if you also used this vehicle for personal trips or exclusively for business. The system works well here because it prompts you to clearly separate business miles driven from personal and performs the standard mileage rate calculation for you. It will also give you an opportunity to maximize this expense by ensuring common fees, like parking, tolls, and car loan interest are entered. Do keep in mind you can track and deduct your mileage for business-related trips, even trips that don’t involve transporting the children in your care, such as going to Costco to buy child care supplies or driving to a child care training. You can also include in this amount your business portion of car loan interest and parking fees and tolls. For your mileage, make sure you keep track of the day, purpose, and total miles because you will need to enter that information for this deduction. It can be something as simple as: “June 9 – 3.25 miles going to Walmart for supplies” Next, you will need to determine if you are using the standard mileage deduction or actual expenses to claim your business vehicle expenses. The system will guide you to the appropriate method based on whether you own or lease the vehicle and the methods that you previously used in past tax years. In general, standard is usually better if you drive a lot of miles. This will get you the miles driven multiplied by the IRS mileage reimbursement rate. The IRS standard mileage rate for 2024 is 67 cents per mile. In addition to those standard miles, you can claim the business portion of car loan interest, parking fees, and tolls paid. However, if you use standard mileage, you cannot deduct other costs associated with your car, including gas, repairs/maintenance, insurance, depreciation, license fees, tires, car washes, lease payments, towing charges, auto club dues, etc. Actual expenses might get you a bigger tax break if you had higher repair, gas, and insurance expenses for the year. With actual expenses, you need to keep track of all payments associated with the business use of the vehicle, including car loan payments. |

|

| Communications | You want to be sure that you are deducting your business communication costs. This is a common expense for child care businesses. Some examples include cell phone service, internet service, second phone line, any fees for things like call waiting or voicemail, long-distance calls, fax, and Video-conferencing services. If you’re a home-based provider and you also use these services for personal use, you will need to perform your time-space percentage on those expenses and enter only the amount associated with business use into the system. TurboTax will not apply it for you. | |

| Supplies | TurboTax will give examples of supplies that you may have used for your child care. Supplies include items you use with the children (such as art supplies), diapers and wipes, toys, learning materials, and cleaning supplies. For home-based providers, TurboTax will allow you to enter in the amount of your expenses but will not apply your time-space percentage to them. This means if you spent $100 on supplies that were used 100% for your business, enter $100 in TurboTax. If you spent $1,000 on supplies that were used for both business and personal use and your time-space percentage is 35%, enter $350 into TurboTax. | |

| Office Expenses | This deduction is pretty straightforward, and TurboTax gives examples of what this may include. Here’s where you want to include amounts paid for office supplies (such as ink, toner, paper, staples, writing utensils, office furnishings, etc.) and postage, as well as your business communication service costs (such as cell phone service, internet service, second phone line, fax, and video conferencing services). It is rare for providers not to have some expenses in this category. Home-based providers should be mindful of how they enter their office expenses, however. If the expenses were 100% business use, then you can enter the full amount of your expenses to deduct. If the expense were for both personal and business use, you will first apply your time-space percentage, then enter that amount as your expense. |

|

| Employee Wages and Work Credits | Make sure that the wages you enter are only for W-2 employees reported to the government. As a sole proprietor, you cannot pay yourself as an employee. You can take money out of the business, but your “pay” is considered the amount on Line 31 (your net profit or loss) so there’s no need to enter money you took out for yourself throughout the year here. | |

| Contract Labor | The system asks if you made any payments that required you to issue a form 1099. If you issued a form 1099 to someone that you contracted to perform a service, like cleaning, or a substitute, and you paid them more than $600, you will enter the amount paid. Note – In some cases, child care providers issue 1099 to employees, or helpers and substitutes. If you issued any 1099, enter it as contract labor but be mindful that you are classifying your employees properly. Typically, if you direct how someone works, they are an employee. For more information on classifying staff, use the Employee vs. Contractor app, available through the generous support of Low Income Investment Fund (LIIF). |

|

| Legal and Professional Services | Include any fees you paid to a lawyer, accountant, or tax preparer, for business use only, as well as membership fees for professional memberships like the National Association of Family Care or the National Association for the Education of Young Children. | |

| Taxes and Licenses | You can enter taxes (and local taxes, excluding federal taxes) and business license fees here. These should only be taxes and fees that are 100% related to your business. For example, your licensing fee so you can operate a home-based business or a child care business would be entered. | |

| Utilities | This applies to you if you have a separate office or other business property that's not part of your home. Home-based providers will include their utilities costs in a different part of the program, which covers business use of the home. Many providers will have utility costs which include utilities such as gas, electricity, internet, or water. This also includes trash collection, pest control service, and security alarm monitoring service. | |

| Employee Benefits | Do you have a company health or accident insurance program? This includes programs associated with your business (not your personal expense) like accident and health plans, group-term life insurance, and dependent care assistance programs. If you offer child care or education assistance, include that here. | |

| Business Insurance | This is for insurance other than health. Include your general liability insurance, renter’s, fire/theft/flood, and worker's compensation insurance if you have employees. Home-based providers should not include your homeowner’s/renter’s insurance (that will be in the section on deducting the business use of your home). | |

| Health Insurance Premiums | Here you will enter the total amount of health insurance premiums you paid for yourself, your spouse, and your dependents (under age 27) during the tax year. You can deduct up to 100% of health insurance premiums for you, your spouse, and your dependents if you're self-employed and have a net profit from the business for which you created the plan. This does not include any premiums you may have paid through a spouse's health insurance offering through their employer. If you or your spouse could participate (even if you declined coverage) in an employer's health plan or in a subsided program, like the Affordable Care Act, at any time during a given month, you can't take the deduction for that month. The deduction may be limited if the business has low net earnings. This means that you may not be able to deduct 100% of your premiums. This entry should be reduced by any reimbursement received. These deductions are figured as part of your Form 1040, not as part of Schedule C. |

|

| Building or Land Rental | This is rent paid for property used for work only, not for an office in your home. Rental of your home will be included in the section on deducting the business use of your home. | |

| Credit Card, Loan, and Other Interest | This includes interest you paid directly related to your business (for home-based providers, mortgage interest is reported in the section on the business use of your home). Deductible interest can include interest on business credit cards (not personal ones) and business loans such as the Economic Injury Disaster Loan or an SBA 7a loan. |

|

| Repairs and Maintenance | This includes any repairs and maintenance of the space you use or your equipment. Repairs and maintenance are required for you to conserve or maintain your property – these are repairs that do not add value to the property. Home-based providers should not enter repairs and maintenance expenses here because they will be reported in the section on the business use of your home. |

Less Common Expenses

Common but Often Misunderstood Expenses

Here we will walk you through three important and often misunderstood expenses for child care businesses. Properly claiming these deductions can be a significant financial strategy for your business, however you want to be sure that you are calculating these correctly and have the necessary records on file to back your use of them. They are:

1. Meals

2. The business use of the home (also known as home office)

3. Depreciation/Assets

Meals (100% limit)

This allows providers to enter the cost of fully deductible meals which includes:

Meals served to children (this includes meals that you were reimbursed for by the Food Program (CACFP).

Your or your staff’s business meals (i.e., while on business trips, business meetings, or conferences)

We will primarily focus on the meals served to children. The process for reporting meals served to children differs for home-based family child care programs vs. child care centers.

Child Care Centers

Child care centers must report their actual food expenses when claiming the cost of meals served to children. You must still report the reimbursements received from the food as income.

For example, if your total food costs for the year were $15,000 and you received $11,000 as a reimbursement, you will still enter $15,000 as your meals expense and $11,000 as a revenue line entry labeled “CACFP” or “Food program”.

If you used a food sponsor, you will report your expenses paid and income received from the sponsor, even if you did not receive a 1099 at the end of the year.

Family Child Care Homes

Only home-based providers are allowed to use the standard meal and snack rates for reporting their children's meal expenses. This makes your recordkeeping easier than tracking actual expenses.

According to the IRS Child Care Audit Guide, the allowed rate is based on the Tier I rate under the CACFP. The provider may use the standard meal and snack rate, published by the USDA each year, for a maximum of one breakfast, one lunch, one dinner, and three snacks per eligible child per day. What this means is that you can use the published rates to calculate meal expenses for the children in your care instead of tracking actual spending on food.

There is still a recordkeeping requirement, which includes the name of each eligible child, dates and hours of attendance in the home-based family child care program, and the type and quantity of meals and snacks served. This limit is higher than the amount of meals that CACFP reimburses, so it is advantageous for providers to track and claim all of their meals served.

IMPORTANT NOTE – TurboTax provides inaccurate guidance when it comes to providers who participate in the food program who are reimbursed for food costs. The system advises “If you are reimbursed for meals or snacks, you can deduct only the portion of the standard allowance that exceeds the reimbursement”. The IRS does not recommend using this method. Instead, they recommend reporting your full food costs as an expense and your full food program reimbursements as income. So, providers should enter their full costs, not only the difference between their costs and reimbursements.

While TurboTax provides the current standard meal rates for the tax year, when you enter your costs, you will need to multiply the total meals and snacks served to children for the year by these rates and then enter the amount into the system.

You should use the rates in effect at the start of the tax year. So, for 2024 you would use the 2023-2024 rates, since they were in force on Jan 1, 2024, at the start of the year.

Figure 1: Highlighted inaccurate guidance from TurboTax, providers should in fact enter their full expenses and full reimbursement

Home Office/Business Use of Home

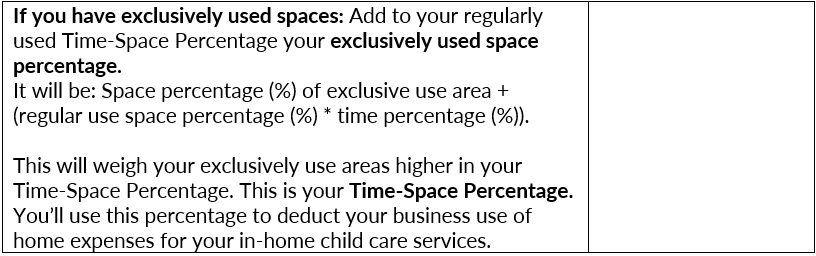

Keep in mind that you can deduct space in your home used exclusively for your child care business. This can include a home office, even if it is just part of a larger room or a storage area where you keep supplies for your business. TurboTax does a great job of guiding home-based providers through the Time-Space Calculation. We recommend that you first calculate your Time-Space Percentage on your own, then enter that data into TurboTax and ensure they match. The TurboTax calculation may be a slight percentage point off, but it’s as close as they can get – still use it!

How do I include the costs of my home?

As a home-based child care provider, if you regularly use your home in your business and are regulated, you can deduct the cost of your home and other related expenses.

To prepare for claiming these deductions on your return, whether you rent or own your home, there are two steps you need to take: 1) determining the space and time used for care and duties related to your business and 2) determining the allowable expenses related to providing care in your home.

Let’s go through each one and know there is a table to record your answer below:

Step 1: Calculating the space and time use of your home

Two elements determine how much of your home expenses be deducted – the space regularly used for care and the amount of time it is used on average. We are going to go through the calculation, but there is also a spreadsheet you can use to make it even easier.

Typically, space is measured in the square feet of your home that is used for care and the total square footage of your home. Regular use includes areas that may be used all day (such as a play area) but also ones that are regularly used for only part of the day. To give an idea of an area that is only used part of the day, the IRS guide to auditing child care providers uses the example of a provider with three children who each nap in different rooms at quiet time (so they can rest better). Though the other rooms are just used at nap time, it is a regular use and can be included in your calculation. If a space is used 3 or more times per week, it could be considered “regularly used for business”. As a reminder, children do not have to have access to the space in order to count it as regular use. Areas for child care material storage, a laundry area, and the garage (if it stores a vehicle used for business, lawn mower, or children’s toys). Garages, whether attached or detached, should be included in the total square footage calculation.

You can then take the space used in your home for care and divide it by the total square footage of your home to get a percentage: Space used for care ÷ total square footage of your home = percentage of your home that you use for child care

For example, a provider uses 500 square feet of her 1,100 square foot home, regularly for care. If she divides 500 by 1,100, she finds that she gets .454 or 45.4% of her home is used regularly for care.

Time is the total number of hours you used your facility on average. This includes not only the time that you care for children, but also the time you used the space for cleaning, cooking, and preparing for the care of your children. You can also include the time when your business was closed but you were preparing to open. For example, let’s say your business is open and provides care for children 10 hours a day typically. During the hours that you are closed, you clean and set up for two hours a day. Combined, this would give you 12 hours a day that you were using your facility. Then let’s say you were closed for four weeks but did 10 hours of work during this time to maintain the space and prepare for re-opening. Your total hours would be:

12 hours a day x 5 days a week x 48 weeks +10 hours when you were closed = 2,890 hours.

You can create a percentage of the business use of your home by dividing your total hours used for care by 8,760 (the total hours in a year).

For example, our provider above uses her home for care 2,890 hours a year. When you divide 2,890 by 8,760 you find that .329 or 32.9% of the time, her home is used for business.

Calculating space and time for the percentage of your home expenses that are deductible is done by multiplying the percentage of space used in your home by the percentage of time the home is used.

In our examples above, the provider is using 45.4% of her home for care that is provided 36.5% of the year. If she multiplies 45.4% times 32.9%, she gets 14.9%. So, she can deduct 14.9% of her home expenses.

Business Use of Your Home: Calculating Space & Time

Example: Business Use of Your Home

A word of caution – TurboTax will recommend that you use the simplified home office deduction which is a maximum of $1,500. For many child care providers, the simplified method represents less than their real costs so they should use the actual expenses method to determine their home office deduction.

Figure 2: Sample Time-Space Percentage calculation performed in TurboTax.

In this example, you can see that the provider’s Time-Space Percentage is 44.5%. This means the provider can claim 44.75% of the majority of their expenses that fall under the business use of the home. These are expenses like rent, mortgage interest, utilities, and repairs. Let’s say these items totaled $10,000 for the year and the provider used actual expenses, their deduction would be $4,475 which is significantly more than the simplified deduction amount of $1500 that Turbo Tax recommended.

Another word of caution - TurboTax does not ask for the number of hours providers work in their homes when children are not present. This makes it very difficult for providers to calculate an accurate Time-Space Percentage. We recommend that you first calculate your Time-Space Percentage using this worksheet and use it to reference as you walk through the TurboTax system. Since TurboTax does not ask how many hours you work when children are not present, you will need to factor that in when you enter the hours per day you used your home for the daycare question. For example, if you usually perform administrative duties, cleaning, and other preparations, totaling 10 hours per week and you’re open 5 days per week, you would add 2 additional hours to each day.

Keep track of the hours you work when children are not present by noting the time you spend preparing your space for children, cleaning, doing administrative tasks, responding to families, etc. The sample log below shows how you can track the number of hours you work in your home and shows how you calculated the number which can help you in case of an audit.

Home-based providers should also be aware that because they’ve included certain expenses like utilities and repairs already under home office, they will not enter those expenses again when they see those categories listed separately as expenses.

Qualified Business Income (QBI) Deduction

Please be mindful of the Qualified Business Income (QBI) deduction. QBI is the net amount of qualified income, deductions, gains, and losses from your child care business. This deduction allows you to deduct up to 20% of your self-employed/small business income from your total taxable income.

Depreciation

Depreciation is the practice of deducting a large business cost over time rather than in just one year. This is usually a requirement when you want to deduct certain large purchases (over $2,500) or an improvement. You can also depreciate your home if you use your home for business.

While you’re in the home office expense view, TurboTax will then ask you to list your home assets that can be depreciated which include the home itself, home improvements, and large purchases.

Figure 3: Sample Depreciation calculation based on the business use of home percentage

You may be curious about what an improvement consists of. An improvement differs from a repair because it is not meant to get something back into working condition, instead, it improves or adds value to the home. TurboTax provides a list of examples of home improvements:

Figure 4: TurboTax Examples of improvements that are subject to depreciation

After you enter details about your home asset, such as the date of purchase and original cost, the system will depreciate the expense, based on your time/space percentage, and provide you with the deductible depreciation amount for it. There is a separate category in TurboTax, Assets, where you can depreciate other large purchases that are not subject to your Time-Space Percentage. You can also learn more about Depreciation by using our online app.

Assets

Assets are items of value owned by a company. Business assets can be many things such as vehicles, real estate, computers, and furniture. Assets add value to your business, and they may be subject to depreciation. Depreciation is the practice of deducting a large business cost over time (over its useful life) rather than in just one year. Not all assets have to be depreciated. Typically, if you made an improvement or made any single purchase of equipment or furniture for more than $2,500 you will need to use depreciation calculations. For example, if you purchased three laptops that totaled $4,500, that means each laptop cost $1,500. Each laptop is not over $2,500 and would not be treated as an asset. If you purchased two computers totaling $6,000, that means each laptop cost $3,000 and would be treated as an asset.

TurboTax will first ask “Do you want to go directly to your asset summary?

Figure 5: Initial Asset Screen

We suggest that you choose the “No, I want to review my answers to the annual elections questions” option. By doing this, the system will help you understand your options for expensing your business property.

Figure 6: Indicate if any assets were over the $2,500 threshold

If you have assets that cost $2,500 or less, you have options to treat them as expenses instead of assets and deduct them fully in one year. This is called the De Minimis Safe Harbor Election. Taking advantage of the de minimis safe harbor election can substantially reduce your business’s income tax burden. If you use this rule, make sure you, or your preparer, includes a statement reading:

“Section 1.263(a)-3(h) De Minimis Safe Harbor Election

Your name

Your address

EIN or Social Security Number

For the year ending December 31, 20__, I am electing the safe harbor election for small taxpayers under Treas. Reg. Section 1.263(a)-3(h) for the following: (list your improvements).”

Figure 7: Determining if an item will be treated as an asset or expense

Figure 8: Indicate again if any assets were over the $2,500 threshold

Figure 9: Indicate if you made any improvements to a building (commercial property only)

You may be curious about what an improvement consists of. An improvement differs from a repair because it is not meant to get something back into working condition, instead, it improves or adds value to the property, for example, installing new plumbing or wiring, installing a fence, and adding a new roof.

There are some special rules in place, however, labeled annual election for improvements in TurboTax, that will allow you to deduct improvement costs as expenses rather than depreciating them over multiple years. For building improvements, there is the Safe Harbor Election for Small Taxpayers election that allows you to treat the improvement as an expense. Usually, you can do this if your gross receipts (business income) are less than $10,000,000 and the building has an unadjusted basis of $1,000,000 (this is the cost before any depreciation that you’ve taken). The cost of the repair must also be the lesser of $10,000 or 2% of the unadjusted basis of your building.

For home-based family child care programs, these improvements would be captured in your business use of the home section already.

Figure 10: Determine if improvements can be treated as an expense or assets

Next, TurboTax will ask about any business assets that you have that aren’t covered by your elections. For example, large purchases over $2,500 or improvements over $10,000.

Figure 11: Questionnaire on business assets

If this applies to you, you will be taken to your Business Asset Summary to add your assets.

Figure 12: Business Asset Summary

You will then need to answer a few questions about your assets, one at a time.

Figure 13: Asset Description (one asset at a time)

Figure 14: Details about the business asset

For items that cost more than $2,500, you will enter details about the item in addition to the date it was placed in service for your business.

Figure 15: Additional details about the business asset

If this is the first year the item was placed in service, you can deduct its full value rather than depreciating it over several years. TurboTax will present you with the following options to deduct the asset:

I’ll spread the deduction over several years

I’ll deduct the full value of the item this year (take the Section 179 deduction)

I’ll take a partial Section 179 deduction

I’ll take a partial Section 179 deduction this year and the 60% special depreciation allowance

I’ll take the 60% special depreciation allowance

Figure 16: Indicate how you choose to deduct the item (straight-line depreciation, bonus depreciation, section 179, etc.)

The method you choose will depend on your overall financial status for the year and how you would like to approach tax planning for the future. This is what TurboTax recommends:

I’ll spread the deduction over several years. Recommended if you anticipate having greater income in the future and you want to reduce your taxable income at that time.

I’ll deduct the full value of the item this year (take the Section 179 deduction). Recommended if your business is showing a profit. We believe most child care businesses will choose this option.

You may be wondering about the difference between the various elections and depreciation methods. This is not an easy concept but if you’ve made it this far, keep on going! TurboTax is built with links to explain more about these concepts and the system does the math and checks for you to ensure you are expensing or depreciating correctly.

Section 179 allows taxpayers to deduct the cost of certain tangible property as an expense the year it’s placed in service. The property must be used for more than 50% of your business, so not one that is primarily for personal use. Buildings and land don’t qualify for Section 179 but building upgrades do. In 2024, you can expense up to $1.22 million of eligible property. This deduction is also limited by your business's net income for the year – you can’t deduct more money than you made. At that point, you can opt to take regular depreciation on the remaining assets or use the remaining of your deduction in the following tax year.

Special depreciation is also known as bonus depreciation. For 2024, this allows you to deduct 60% of the depreciation in the year an asset is placed in service. This rule generally applies to property with 20 years or less useful life (this would not apply to residential or nonresidential real property because they have more than 20 years of useful life). The percentage of depreciation allowed will decrease annually until it ends completely in December 2026.

Most child care businesses may benefit from selecting Section 179 depreciation, which allows you to deduct the full costs in one year.

Figure 17: Asset Summary screen after entering an asset

It’s then added to your asset summary. You’ll repeat this process for each business asset that you have.

Here is a set of simple depreciation worksheets that can help you organize your expenses and determine whether you are going to depreciate an asset or take the full deduction in one year:

Ways That You Can Make Your Tax Preparation Go Smoothly

You’ve done it! You just entered all the information needed on your child care business and can now complete the rest of the screens to complete your overall return.

Many small business owners can perform their own tax preparation to save money and also to ensure their taxes are being done accurately – no one knows your business as you do! The key to hassle-free tax filing is to have proper recordkeeping and bookkeeping throughout the year. Keeping track of all payments you receive and receipts and invoices for your purchases is invaluable and will save you many hours.

When it’s time to submit your taxes, submitting them electronically is far better than printing and mailing your return. This is because there’s a higher degree of accuracy and the process is much quicker.

You may find that you need more time to file or that you have a tax bill and need more time to pay it. If that happens, we suggest that you pay what you can and then request an extension. You will need to put in the request by April 15th, but you can receive an extension for up to 6 months. You will still have to pay additional penalties for not paying on time, but that will be better than ignoring it altogether.

Remember, there is help available! If you’ve purchased the MAX plan through TurboTax, you have access to specialists before, during, and after your filing. You can also receive answers to your tax education questions through the Taking Care of Business Ask the Experts submission form.

Disclaimer

The information contained here has been prepared by Civitas Strategies® and is not intended to constitute legal, tax, or financial advice. The Civitas Strategies® team has used reasonable efforts in collecting, preparing, and providing this information, but does not guarantee its accuracy, completeness, adequacy, or currency. The publication and distribution of this information are not intended to create, and receipt does not constitute, an attorney-client or any other advisory relationship. Reproduction of this information is expressly prohibited. Only noncommercial uses of this work are permitted.

*Note that this guide is not tax, financial advice, or an endorsement of TurboTax. The authors are not affiliated with TurboTax

Previous iterations of this guide made possible through the generosity of Home Grown.